That's the largest increase in the county. A.As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. Whether Quill applies to corporate income and similar taxes is a point of contention between states and taxpayers. In Darrington the average assessed property value grew 23.1% from 2019 to 2020. Understanding California income tax rates can be tricky. The personal and senior exemption amount. For married filing/Registered Domestic Partner (RDP) jointly, qualifying widower, or head of household taxpayers, the standard deduction increases from 9,074 to 9,202 for tax year 2020. See the tables below to view what your California tax rate may be, based on your filing status. How Are California Income Tax Brackets Determined The California income tax brackets are based on taxable income as well as your filing status. Withholding tax figures are out for California 2020 The annual standard deduction for withholding purposes will rise from $4,401 to $4,537, and the value of a withholding allowance will rise from $129.80 to $134.20. The standard deduction amount for single or separate taxpayers will increase from 4,537 to 4,601 for tax year 2020. There are nine California tax rates, and they are based on a taxpayer’s adjusted gross income. A 1 mental health services tax applies to income. As shown in Figure 8, property tax revenue from the 1 percent rate is distributed to counties, cities, K–12 schools, community college districts, and special districts.Īlso Know, did California taxes go up in 2020? Here is a list of our partners and here's how we make money. The average effective (after exemptions) property tax rate in California is 0.79%, compared with a national average of 1.19%.Īlso, where do property taxes go in California? All property tax revenue remains within the county in which it is collected to be used exclusively by local governments. 2015 California Tax Tables with 2022 Federal income tax rates, medicare rate, FICA and supporting tax and withholdings calculator. If you make 17,000 a year living in the region of California, USA, you will be taxed 2,124.

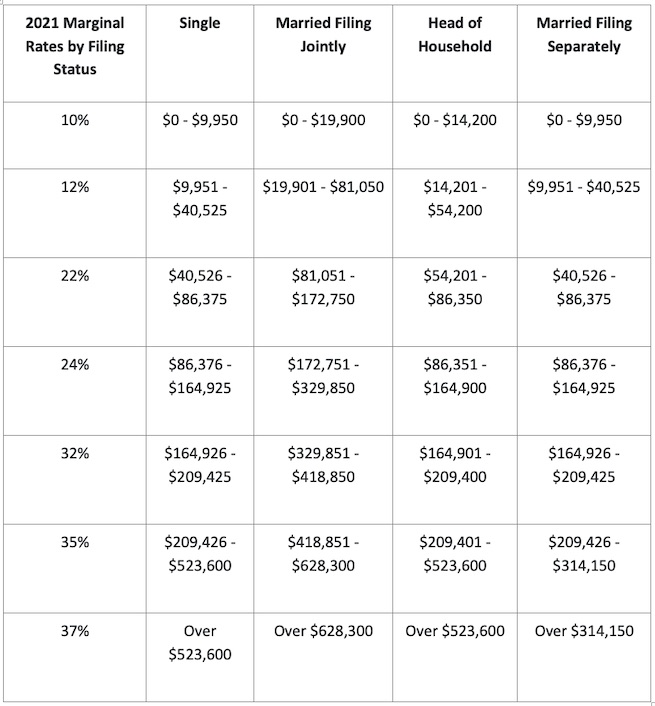

The income brackets, though, are adjusted slightly for inflation. In 2016, California had the 17th-highest per-capita (per-person) property tax revenue in the country at $1,559, up from 31st in 1996.īesides, how much is the property tax in California?Ĭalifornia's overall property taxes are below the national average. What are the income tax brackets for 2020 The federal income tax rates remain unchanged for the 20 tax years: 10, 12, 22, 24, 32, 35 and 37. Schedule to determine Total Income and Deductions and California Source. California has the highest marginal income and capital gains tax rate and is in the top ten highest corporate tax and sales tax rates nationally. The State of California (through the Franchise Tax Board) requires an annual.

0 kommentar(er)

0 kommentar(er)